Stop Renting! Start Owning Your Today!

Even if the bank says “not yet,” our Flex-Lease program provides your pathway to dream home ownership—lock in your price today while you prepare for tomorrow.

You have the down payment. You’re ready to own a home—but traditional lenders aren’t ready for you. That changes now.

Your Second Chance At The American Dream

Watch this short video to discover how our Flex-Lease program helps families like yours overcome financing barriers and become homeowners—even in today’s high-interest-rate environment.

Ready to take the first step? Our consultation is completely free and no-obligation. If our program isn’t the right fit for you, we’ll tell you honestly.

Your Not Alone - And Its Not Your Fault

In today’s market, traditional financing has become out of reach for most families. High interest rates, strict lending requirements, and outdated qualification criteria are keeping great families out of homeownership.

Maybe you’re:

- Self-employed with excellent income but documentation challenges

- Recovering from divorce, medical bills, or past financial setbacks

- Building credit but not quite there yet

- Dealing with debt-to-income ratios that don’t reflect your real ability to pay

- Frustrated because you have money for a down payment but can’t get approved

The truth is simple: You’re ready to be a homeowner. The system just hasn’t caught up with your reality yet.

That’s where we come in.

Introducing the Flex-Lease Program

Your Bridge to Homeownership

A proven pathway that lets you move into your dream home today while preparing to own it tomorrow.

Build Real Equity

Lock In Your Price

Get Expert Support

The Process Is 4 Simple Steps

From Application to Keys in Hand: Your Journey to Homeownership

Step 1: Apply & Consult (48 hours)

Step 2: Find Your Dream Home (2-6 weeks)

Step 3: Qualify & Review (1 week)

Step 4: Move In & Build Equity (1-3 years)

Why Choose Flex-Lease Over Traditional Renting?

Yes, It Costs Slightly More Than Renting—Here’s What You Get in Return

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Traditional Renting

Our Flex-Lease Program

![]() Money disappears monthly

Money disappears monthly

![]() No path to ownership

No path to ownership

![]() Landlord can raise rent anytime

Landlord can raise rent anytime

![]() No credit improvement help

No credit improvement help

![]() Can’t make it “yours”

Can’t make it “yours”

![]() Rent forever

Rent forever

![]() Build credit towards your closing costs

Build credit towards your closing costs

![]() Purchase price locked in from day one

Purchase price locked in from day one

![]() Predictable payments, clear timeline

Predictable payments, clear timeline

![]() Credit coaching & mortgage broker support

Credit coaching & mortgage broker support

![]() Test drive your neighborhood & future home

Test drive your neighborhood & future home

![]() Own in 1-3 years

Own in 1-3 years

Bottom Line:

You’re not just paying rent—you’re investing in your future, building equity, and securing your family’s dream home while preparing for ownership.

Real Families, Real Dream Homes, Real Results

These aren’t just transactions to us – they’re lives changed, families stabilized, and dreams realized.

Story 1: A Young Family’s Fresh Start

The Challenge:

A mother, her daughter, the daughter’s boyfriend, and their small baby needed a stable home but had limited income and couldn’t qualify for traditional financing. They were stuck in the rental cycle with no path forward.

Our Solution:

We worked with them to structure a Flex-Lease with a modest down payment they could afford and monthly payments that fit their budget. They moved into a home in a safe neighborhood where they could raise their growing family.

The Outcome:

They’re still in the home today, building equity month by month, and working toward their purchase date. What seemed impossible became their reality—a stable home, a clear path to ownership, and a future they can count on.

Story 2: A Mother’s Fight for Her Children

The Challenge:

During the COVID pandemic, a single mother lost her job after refusing to wear a mask at work. She began falling behind on her mortgage payments and faced losing her home—all while fighting a child custody battle that required significant legal fees. She had equity in her home but couldn’t refinance due to her employment situation.

Our Solution:

We purchased her home with a traditional loan, providing her approximately $175,000 in cash for her legal defense. Then we gave her a lease-option back on the property so her children could stay in their home, in their schools, without disruption during an already difficult time.

The Outcome:

She won her custody case and maintained stability for her children during her final year of life. Though she tragically passed away within a year of our closing, her children were able to remain in familiar surroundings during an unimaginably difficult time. The home has since provided another young couple with their pathway to homeownership—they’re currently in the lease-option program and working toward purchasing it.

This story reminds us why we do what we do: Real people facing real challenges need real solutions, not just bureaucratic lending requirements.

Story 3: Preserving a Family Legacy

The Challenge:

An elderly gentleman owned a million-dollar home he’d purchased 50 years earlier for a modest sum. He needed to move to Oregon to be with family, but selling would trigger approximately $150,000 in capital gains taxes even after the personal residence exemption. Traditional sale wasn’t just slow—it was financially devastating for his estate.

Our Solution:

We structured a creative lease-option timed to extend until after his passing. This allowed him to move immediately to be with family while receiving monthly income from the property.

The Outcome:

When he passed, his children inherited the property with a stepped-up tax basis, receiving the full value of the home without paying a single dollar in capital gains taxes. We saved his estate $150,000 and preserved his legacy for his children—exactly as he wanted.

This demonstrates our commitment: We don’t just do deals—we solve complex problems with sophisticated, ethical solutions that honor our clients’ wishes.

These families took the first step by reaching out. What’s your story? Let’s write your success chapter together.

Why Now Is Actually The PERFECT Time For Flex-Lease

With today’s high interest rates, traditional financing has pushed monthly mortgage payments out of reach for most families. A home that would have cost $2,000/month two years ago now costs $3,200/month with conventional financing.

But here’s what most people don’t realize: While everyone else is waiting for rates to drop, you could be:

- Living in your dream home right now

- Locking your purchase price now

- Building up to $6,000 towards your closing costs

- Improving your credit scores so you are first in line when rates improve

- Test-driving your neighborhood & home before fully committing

The question isn’t whether you can afford to do this.

The question is: Can you afford to keep waiting?

SELLERS: Can't Sell Your Home? We Have a Plan B

If your home has been sitting on the market—or you know traditional listing won’t work—we offer creative solutions that get you results.

The Seller's Dilemma:

You need to sell, but:

- ❌ The market is slow in your area

- ❌ Your home needs repairs you can’t afford

- ❌ You need to relocate quickly for work or family

- ❌ You’re tired of being a landlord

- ❌ You owe more than current market value

- ❌ Traditional buyers keep falling through

Sound familiar? You’re not stuck.

- Flexible Terms: Tailored agreements to suit your financial situation.

- Build Equity: Start building equity while you rent.

- Expert Guidance: Professional support throughout the entire process.

Our Solution for Sellers

What We Offer:

✓ Full asking price through creative financing (not lowball cash offers)

✓ Zero commissions to pay

✓ No repairs needed – we take it as-is

✓ Fast closing or flexible timeline – whatever works for you

✓ We handle everything – tenant management, maintenance, headaches

✓ High-quality tenant-buyers with ownership mentality and significant deposits at risk

How It Works:

We specialize in subject-to financing and lease-options that allow you to get the price you want while we take over payments and responsibilities. You get peace of mind, monthly income (in some structures), and a clear exit strategy.

Real Seller Success:

Remember the elderly gentleman who saved his estate $150,000 in taxes? Or the single mother who got $175,000 in cash when banks said no? These aren’t just buyer success stories—they’re seller solutions that traditional real estate couldn’t provide.

Or call our AI assistant to book your Zoom call: 425-546-1546

Why families and Sellers Trust Lease2OwnDreamHome.com

Our Commitment:

We live by a simple rule borrowed from Wendy’s founder Dave Thomas:

“We do what we say we will do, when we say we will do it.”

No exceptions. No excuses. Just honest, ethical business.

Our Credentials:

Helping families achieve homeownership across the Western United States since 2017

✓ Better Business Bureau Member

Committed to ethical business practices and customer satisfaction

Active leadership in the professional real estate community

Currently teaching our methods to new investors who share our values

We’ve been through the worst and emerged with valuable lessons about helping people, not just making deals

Our Operating Principles:

Total Transparency

- All agreements provided in writing

- We encourage legal review of all documents

- No hidden fees or surprise costs

- We only get paid when you close—no fees unless you succeed

No-Pressure Approach

- Free consultation with no obligation

- If our program isn’t right for you, we’ll tell you honestly

- We’d rather lose a deal than put someone in the wrong situation

Full Support Throughout

- Credit repair specialist connections

- Mortgage broker network that understands our program

- Monthly or quarterly credit coaching

- Regular communication via text/email

- We stay in touch—you’re never alone on this journey

Proper Vetting for Everyone’s Protection

- Thorough tenant screening

- Licensed mortgage originator review before signing

- We ensure tenant-buyers are on the path to ownership

- Significant deposits required—everyone has skin in the game

What Makes Us from Other Investors

National Lease-Option Companies

Lease2Own Dream Home

Rigid, one-size-fits-all terms

Rigid, one-size-fits-all terms

Flexible Flex-Lease customized to your situation

Flexible Flex-Lease customized to your situation

Corporate, impersonal process

Corporate, impersonal process

Local presence in every market we serve

Local presence in every market we serve

Just collecting rent

Just collecting rent

Actively helping you succeed in purchasing

Actively helping you succeed in purchasing

Hidden fees and unfavorable terms

Hidden fees and unfavorable terms

Transparent, fair, ethical—no fees unless you close

Transparent, fair, ethical—no fees unless you close

You’re a number

You’re a number

|

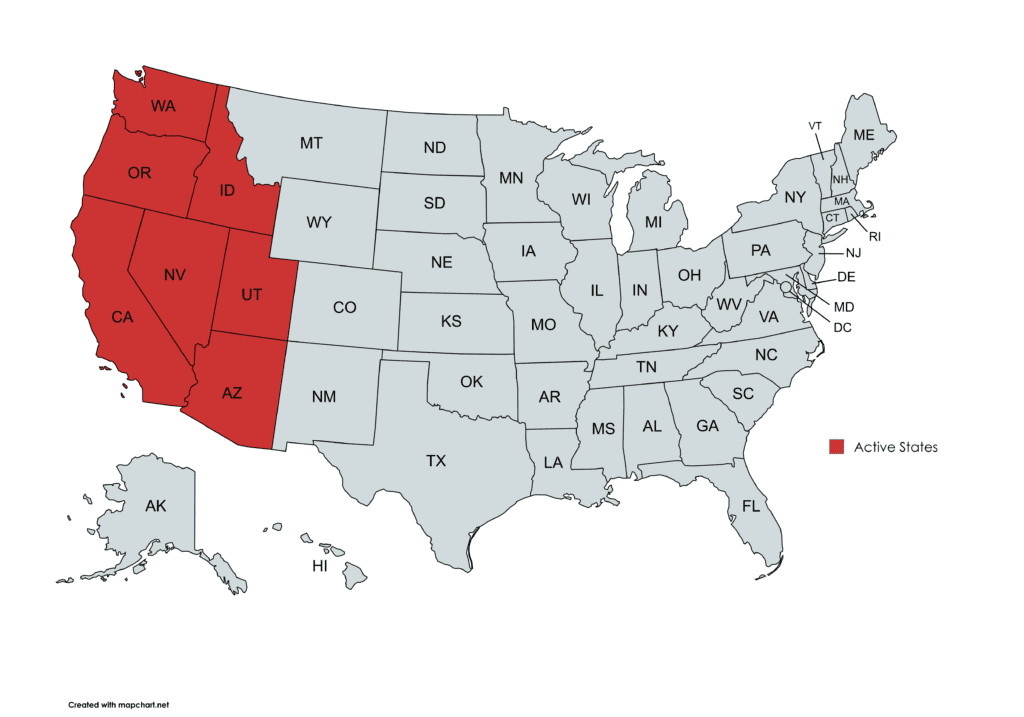

Our Markets:

We’re proud to serve families and sellers in:

- 🏔️ Seattle, WA – Puget Sound region

- 🌲 Spokane, WA – Eastern Washington

- ⛰️ Boise, ID – Treasure Valley

- 🏔️ Salt Lake City, UT – Wasatch Front

- 🌵 Tucson, AZ – Southern Arizona

- 🎰 Las Vegas, NV – Clark County

- 🌾 Fresno/Stockton, CA – Central Valley